While the greatly eroded wealth in Banks in 2009 and that taking place now in Europe continues to take its toll., the world’s pecking order has changed. The Emerging Markets have become the Developed Markets and vice versa. Thus the 56% vote in IMF that Europe and Us hold may well become the distressed majority while the remaining 44% with most likely a Chinese Dy managing Director in tow become the growing minority dissident vote or so some thought. china and US rallied behind the lady Lagarde and DSK is finally out with poll propaganda a much more credible presidential candidate

While global governance is at best a fig leaf for a shaky foundation of war mongering (NATO), Modern revolution ( Iraq, Egypt, Syria ) and the atrocites in Afghanistan and inner Mongolia/north western China cannot be equated, there is a surfeit of mediocrity being paid in flowin rivers of indonesian Rupiah, Mexican Pesos, Brazilian Riais and even in new look Indian Rupees, that survives on browbeating discipline, sucking upto politicians and spending solely from their salary account. For this majority, the term global professionals has histrionically been applied by us in the reform business, thinking we have our big bucks safeguarded by the salaried majority. But the salaried majority much like the developed nations of the last millenium, stagnate, run distress valuations on their and their local retailer’s franchise and have much gutter cleaning to avoid and postpone to partake of real work. Not the rambling about the crisis surely, my regular readers will ask. And they will be right..As friends of entrepreneurs as passers on of classified and confidential information and more respectably as career bureaucrats, these salaried pros have survived on either their own bonus or cribbing about the others’ bonuses for a long time.

Asking them to take stock, as part of their pay or as their duty is akin to inviting bulls to your own china shop as they detest and loathe reason, getting deserving passes to come into business homes and flailing students hostels and destroy their family lives for a peaceful Sunday and Weekend. As a professional i have seen many such colleagues and have enjoyed the 5 day work week to the hilt engaging myself in traveling, treating my investment banking career as a sure hobby and not much else, and working out deals with more than 5-10 rudimentary failures to assess and partake of the present and its business models, as also multiple failures to appreciate that there work without such lacunae could make a meaningful device. Thus, the greater part of my world has become the growing dark abyss of It support and Business Process Transformation, an industry worth $200 bln with India’s 1/3 share and that of the top 4 management consultants even greater. However, those in that sector have no out anymore and they should not fool themselves as these products and the consultants supporting them have become part of the legacy tree which will keep bearing fruit forever, infinitely better than any bailout but not much more for anyone

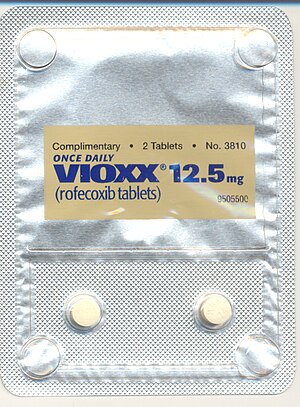

The other equal abysses to choose from like Infrastructure, construction bubbles with its arcane desire for a 20% uptick every other year and the never growing cottage industry of education also remain good avenues for the fools in government to fool those not in government. But healthcare has somehow crossed the rubicon.

Helped by the efforts of NGOs like the GAVI alliance in Africa and Asia, the gaps in medicine and the frequent returns for innovation from healthcare research companies show a desire in the market to watch growth fructify gainfully. also recent cost cutting efforts at Pfizer and Glaxo show that apart from Growth even the big 4 in the industry are ready to embrace a lower cost model and even the Affordable Care act with its many compromises may see success in the near term.

(PDF: 65 KB / 17 pages)

(PDF: 65 KB / 17 pages)