Image via Wikipedia

Image via Wikipedia Reuters Q3 report

Merck & Co Inc reported disappointing quarterly sales and took an almost $1 billion charge related to a previously disclosed U.S. government probe of its recalled Vioxx arthritis drug, sending its shares 2.1 percent lower.

Merck (MRK.N), like most big U.S. drugmakers in the third quarter, beat profit forecasts on Friday even though its sales fell short, as results were bolstered by cost cuts or other factors. And as with its rivals, investors seemed to pay greater heed to the sales disappointment.

"The third quarter featured slightly lighter revenues, better expenses and better tax rate," said Credit-Suisse analyst Catherine Arnold of Merck's results, describing them as a "low quality beat" because of the sales shortfall.

The earnings report includes an array of drugs and consumer products acquired through the company's purchase last November of New Jersey rival Schering-Plough.

Global revenue almost doubled to $11.12 billion in the quarter. But that was shy of the average Wall Street forecast of $11.24 billion.

Analysts said growth of arthritis drug Remicade, acquired in the Schering-Plough merger, was weaker than expected due in part to price pressures in Europe.

Third-quarter earnings of the combined company fell 89 percent to $372 million, or 11 cents per share, reflecting merger charges and a charge for setting aside a $950 million Vioxx legal reserve.

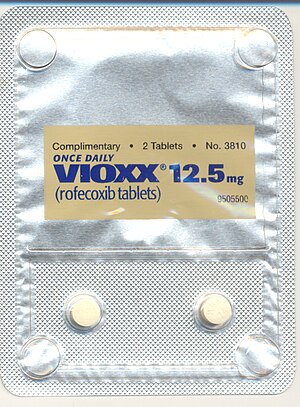

The charge relates to an ongoing probe by U.S. prosecutors in Massachusetts of how Merck had marketed Vioxx -- Merck's onetime blockbuster arthritis drug that was recalled in 2004 after being linked to heart risks.

Image via WikipediaRelated articles

Image via WikipediaRelated articlesMerck's Earnings Slump On Cost Of Digesting Schering (forbes.com)